Exploring the Fascinating World of High-Frequency Financial Services

The Rise of High-Frequency Trading in Financial Markets

In the realm of financial markets, one trend that has been gaining significant traction over the past few decades is the advent of high-frequency trading (HFT). This practice involves using sophisticated algorithms and cutting-edge technology to execute trades at a rapid pace, often in a matter of microseconds. The rise of HFT has revolutionized the way trading is conducted, but it has also sparked controversy and debate regarding its impact on market stability and fairness.

High-frequency trading has its roots in the early 2000s when advancements in computing power and telecommunications infrastructure allowed for lightning-fast trade execution. Today, HFT firms compete fiercely with each other to gain an edge in speed and efficiency, employing complex strategies that capitalize on minute market inefficiencies. By placing a high volume of trades in quick succession, these firms aim to profit from small price discrepancies that may only exist for a fraction of a second.

The Technology Behind High-Frequency Trading

At the heart of high-frequency trading lies advanced technology that enables firms to execute trades at blistering speeds. These firms invest heavily in state-of-the-art hardware and software, including powerful servers, low-latency network connections, and specialized algorithms. By colocating their servers in close proximity to exchange data centers, HFT firms can minimize the time it takes for trade orders to reach the marketplace, giving them a crucial advantage over slower market participants.

Furthermore, HFT algorithms are designed to react to market events in real-time, swiftly adjusting trading strategies based on incoming data feeds and signals. By processing vast amounts of market data at lightning speed, these algorithms can identify fleeting opportunities and execute trades before human traders even have a chance to react. However, this rapid-fire approach to trading has raised concerns about market manipulation and systemic risks, prompting regulators to scrutinize the activities of HFT firms more closely.

The Impact of High-Frequency Trading on Market Dynamics

The proliferation of high-frequency trading has had a profound impact on market dynamics, reshaping the way securities are bought and sold. Proponents of HFT argue that it increases market liquidity, narrows bid-ask spreads, and improves price efficiency by incorporating a vast array of information into trading decisions. This, in turn, benefits investors by reducing transaction costs and enhancing market efficiency.

On the flip side, critics of high-frequency trading point to its potential destabilizing effects on financial markets. The lightning-fast nature of HFT can amplify market volatility and lead to sudden price swings, as seen in flash crashes where prices plummet or soar within minutes. Moreover, concerns have been raised about HFT’s impact on market integrity, particularly in terms of providing equal access to market information and resources for all participants.

Looking Ahead: The Future of High-Frequency Financial Services

As technology continues to evolve and markets become increasingly interconnected, the landscape of high-frequency financial services is poised for further transformation. Regulatory bodies are grappling with the challenge of striking a balance between fostering innovation and safeguarding market integrity, as they seek to address the regulatory implications of high-frequency trading practices.

In the coming years, we can expect to see continued advancements in HFT technology, driven by artificial intelligence, machine learning, and other emerging technologies. These developments are likely to usher in a new era of automated trading strategies that push the boundaries of speed and efficiency, while also raising important questions about the ethical and regulatory considerations surrounding high-frequency financial services.

-

01

Packaging Machinery: Beyond Sealing, Driving an Efficient, Smart, and Sustainable Future

21-01-2026 -

02

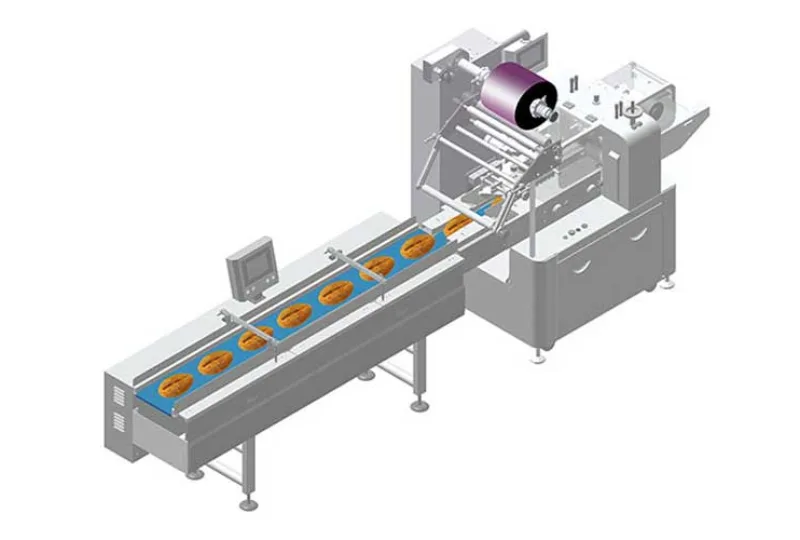

Automatic Tray Loading and Packaging Equipment: Boost Efficiency to 160 Bags/Minute

21-11-2025 -

03

Automatic Soap Packaging Machine: Boost Productivity with 99% Qualification Rate

21-11-2025 -

04

A Deep Dive into Automatic Toast Processing and Packaging System

18-11-2025 -

05

The Future of Bakery Production: Automated Toast Processing and Packaging System

18-11-2025 -

06

Reliable Food Packaging Solutions with China Bread, Candy, and Biscuit Machines

11-10-2025 -

07

High-Performance Automated Food Packaging Equipment for Modern Production

11-10-2025 -

08

Reliable Pillow Packing Machines for Efficient Packaging Operations

11-10-2025 -

09

Advanced Fully Automatic Packaging Solutions for Efficient Production

11-10-2025 -

10

Efficient Automatic Food Packaging Solutions for Modern Production

11-10-2025